Ultimate card issuing.

At a global scale.

For traditional banks, digital banks

and high-performing fintechs.

Through our superior Cloud-based infrastructure, global reach, and industry-leading APIs, we enable banks, digital banks and fintechs to rapidly issue and process cards, anywhere in the world, at scale.

Trusted by

More power. More reach. More possibilities.

Truly global

We have clients, and on-the-ground teams with regional expertise, in 50+ countries, on 5 continents, across 14 time zones.

Cloud-native

Superior capability across multiple Cloud platforms – shared or dedicated – with unmatched APIs, flexibility and speed.

Scalability at speed

With higher processing capacity, greater speed, and richer data, we're able to exponentially scale without disruption.

Richer, faster data

Easily innovate, deploy and customise products, to more insightfully connect with customers, while reducing operational costs.

Speed to market

Unbeatable time-to-market, from first handshake to first transaction, through unmatched APIs and regional experience.

Trusted by winners

We have more than 24 years' experience, powering leading banks, digital banks and fintechs, such as Wio and Mox.

Features that drive you forward

The global processor with true worldwide reach

We have payments experts with deep, local market knowledge, on the ground, in 67 countries, across 14 time zones, guaranteeing 24/7 global support.

Processing in 50+ countries and counting

We're right at home inAsia

- Asia

- Africa

- Latin America

- Middle East

- Europe

- We have programmes live in 9 Asian countries.

- We power large regional clients, including Mox, Livi, Grab, True, Agoda and more.

- We have local teams on the ground in Hong Kong, Thailand, Vietnam, Philippines, Singapore, Japan, Myanmar, Indonesia, India and Nepal.

We're right at home inAfrica

- Asia

- Africa

- Latin America

- Middle East

- Europe

- We have programmes live in 13 African countries.

- We power large regional clients, including Safaricom, Vodacom, Orange and more.

- We have local teams on the ground in Kenya, Ivory Coast, South Africa and Zimbabwe.

We're right at home inLatin America

- Asia

- Africa

- Latin America

- Middle East

- Europe

- We’re fully operational in Mexico, Brazil and the Caribbean.

- We power large regional clients including Mibo and Albo.

- We have a fully-staffed team across Latin America.

We're right at home inMiddle East

- Asia

- Africa

- Latin America

- Middle East

- Europe

- We have offices in Dubai, with staff across the region.

- We have live card programmes in Saudi Arabia, Egypt, Jordan, the UAE, Palestine and Pakistan.

- We power large regional clients, including Tweeq, Wio Bank and D360.

We're right at home inEurope

- Asia

- Africa

- Latin America

- Middle East

- Europe

- We have headquarters in London and a full team across Europe.

- We support heavyweight European clients, including Quicko, Nomo and Monese/XYB.

- We have live card programmes in Poland, Portugal and the United Kingdom.

Create cards instantly with

the most powerful, most

secure APIs

Superior capability.

Powerful APIs

Our APIs are more sophisticated, more secure, more flexible, and more comprehensive, out of the box.

{

client_id: 760131,

user_id: 760131,

remarks: “Creating card For Customer“,

input_type: “t“,

input_id: 520872406,

api_call_unique_identifier: 438574845790657485,

}

Test products in minutes

Decrease second-line fraud disputes

Protect data with Maker and 2FA

You decide.

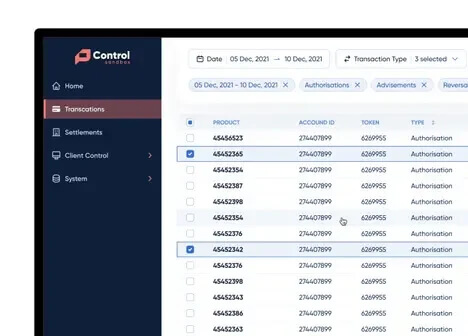

PayControl

Your portal to control rules, issue cards and manage your own programmes.

Detailed system logs

Optimise back-office expenses

Easily understandable data

Giving back

and changing lives

Start innovating your payments with us

We combine the most advanced, multi-cloud platform, with the widest global reach, experience, and presence in the world.